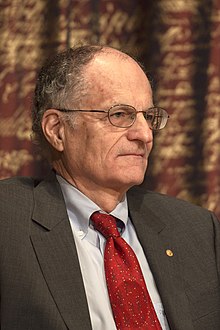

Thomas J. Sargent

Thomas John "Tom" Sargent (born July 19, 1943) is an American economist, who is currently the W.R. Berkley Professor of Economics and Business at New York University. He specializes in the fields of macroeconomics, monetary economics and time series econometrics.

Quotes

edit- For policy, the central fact is that Keynesian policy recommendations have no sounder basis, in a scientific sense, than recommendations of non-Keynesian economists or, for that matter, non-economists.

- Robert Lucas, Jr. and Thomas J. Sargent, "After Keynesian macroeconomics", After the Phillips Curve: Persistence of High Inflation and High Unemployment (1978).

- An alternative “rational expectations” view denies that there is any inherent momentum in the present process of inflation. This view maintains that firms and workers have now come to expect high rates of inflation in the future and that they strike inflationary bargains in light of these expectations.

- Thomas J. Sargent, "The Ends of Four Big Inflations" (1981).

- It is paradoxical that an administration that came to office rejecting the whole apparatus of Keynesian economics finds itself presiding over a stream of what threaten to be permanent deficits.

- Thomas J. Sargent "Back to Basics On Budgets", The New York Times (August 10, 1983).

- My published work is just a record of my learning. I'm sharing it with people so they won't make the same mistakes that I did. It's been a painful and slow process. My work is like a journey, a journey of discovery.

- Thomas J. Sargent, in Conversations with Economists (1983) by Arjo Klamer

- My recollection is that Bob Lucas and Ed Prescott were initially very enthusiastic about rational expectations econometrics. After all, it simply involved imposing on ourselves the same high standards we had criticized the Keynesians for failing to live up to. But after about five years of doing likelihood ratio tests on rational expectations models, I recall Bob Lucas and Ed Prescott both telling me that those tests were rejecting too many good models.

- Thomas J. Sargent interviewed by George W. Evans & Seppo Honkapohja, Macroeconomic Dynamics, 9, 2005, 561–583.

- I remember how happy I felt when I graduated from Berkeley many years ago. But I thought the graduation speeches were long. I will economize on words.

Economics is organized common sense. Here is a short list of valuable lessons that our beautiful subject teaches.1. Many things that are desirable are not feasible.

2. Individuals and communities face trade-offs.

3. Other people have more information about their abilities, their efforts, and their preferences than you do.

4. Everyone responds to incentives, including people you want to help. That is why social safety nets don’t always end up working as intended.

5. There are tradeoffs between equality and efficiency.

6. In an equilibrium of a game or an economy, people are satisfied with their choices. That is why it is difficult for well-meaning outsiders to change things for better or worse.

7. In the future, you too will respond to incentives. That is why there are some promises that you’d like to make but can’t. No one will believe those promises because they know that later it will not be in your interest to deliver. The lesson here is this: before you make a promise, think about whether you will want to keep it if and when your circumstances change. This is how you earn a reputation.

8. Governments and voters respond to incentives too. That is why governments sometimes default on loans and other promises that they have made.

9. It is feasible for one generation to shift costs to subsequent ones. That is what national government debts and the U.S. social security system do (but not the social security system of Singapore).

10. When a government spends, its citizens eventually pay, either today or tomorrow, either through explicit taxes or implicit ones like inflation.

11. Most people want other people to pay for public goods and government transfers (especially transfers to themselves).

12. Because market prices aggregate traders’ information, it is difficult to forecast stock prices and interest rates and exchange rates.- Thomas J. Sargent, University of California at Berkeley graduation speech (2007), quoted in David Glasner, "Memo to Tom Sargent: Economics Is More than Just Common Sense" (2014)

- Q: “Professor Sargent, can you tell me what CD rates will be in two years?”

Sargent: “No.”- Thomas J. Sargent in: Ally Bank TV Spot, 'Predictions' Featuring Thomas Sargent.

"Rational expectations and the dynamics of hyperinflation." 1973

editThomas J. Sargent and Neil Wallace. "Rational expectations and the dynamics of hyperinflation." International Economic Review (1973): 328-350.

- Cagan’s adaptive mechanism for explaining expectations of inflation has sometimes been criticized as an ad hoc formulation that is inconsistent with the hypothesis that expectations are rational. In this paper, we have showed that conditions exist under which adaptive expectations are fully rational.

- What policymakers (and econometricians) should recognize, then, is that societies face a meaningful set of choices about alternative economic policy regimes.

- These ideas have implications not only for theoretical and econometric practices but also for the ways in which policymakers and their advisers think about the choices confronting them. In particular, the rational expectations approach directs attention away from particular isolated actions and toward choices among feasible rules of the game, or repeated strategies for choosing policy variables. While Keynesian and monetarists macroeconomic models have been used to try to analyze what the effects of isolated actions would be, it is now clear that the answers they have given have necessarily been bad, if only because such questions are ill-posed.

Quotes about Thomas J. Sargent

edit- Tom Sargent is a bit out of touch with the real world up there in his office in Minneapolis. A lot of the disagreement is ideologically based, though certainly not on Tom's part. I see this by talking to people. Certain people have a capacity for ignoring facts which are patently obvious, but are counter to their view of the world; so they just ignore them.

- Alan S. Blinder, in Conversations with Economists (1983) by Arjo Klamer

- I remember a seminar here while Tom was visiting in Chicago. Every body was talking; it was a very chaotic seminar. In the middle of the seminar. Tom made some point and the speaker didn't seem to understand it. Tom dropped it and didn't say anything for the rest of the seminar. At the end, he just handed the speaker a piece of paper with a bunch of equations on it and said, "Here's what I was trying to say." I thought it was a very friendly, constructive thing to do, but the speaker said, "this is Sargent's idea of a conversation" and laughed. I think it's just that Tom thinks he can get things settled on a more technical level. Tom and I talk quite a bit. I think that we influence each other a lot.

- Robert E. Lucas, in Conversations with Economists (1983) by Arjo Klamer

- Sargent said in a talk here last year that it is simply a methodological mistake to regard any macroeconomic policy action as an isolated episode. The only legitimate way to think of economic policy is as if the government adopts a policy rule (which may have a random element). What he meant was that he can't apply his methods to isolated policy episodes. My reaction is that the man in the street or even the man in the corporation boardroom, looking at the US Congress making macroeconomic policy, regards it as a possibly unstable episode. He not only doesn't know how it is going to come out, he doesn't imagine it to be the application of a policy rule plus a random error.

- Robert Solow, in Conversations with Economists (1983) by Arjo Klamer

- Suppose someone sits down where you are sitting right now and announces to me that he is Napoleon Bonaparte. The last thing I want to do with him is to get involved in a technical discussion of cavalry tactics at the Battle of Austerlitz. If I do that, I'm getting tacitly drawn into the game that he is Napoleon Bonaparte. Now, Bob Lucas and Tom Sargent like nothing better than to get drawn into technical discussions, because then you have tacitly gone along with their fundamental assumptions; your attention is attracted away from the basic weakness of the whole story. Since I find that fundamental framework ludicrous, I respond by treating it as ludicrous – that is, by laughing at it – so as not to fall into the trap of taking it seriously and passing on to matters of technique.

- Robert Solow, in Conversations with Economists (1983) by Arjo Klamer, p. 146

- Using the popular macroeconomic models of the time, Lucas and Sargent showed how replacing traditional assumptions about expectations formation by the assumption of rational expectations could fundamentally alter the results. … Most macroeconomists today use rational expectations as a working assumption in their models and analyses of policy. This is not because they believe that people always have rational expectations. Surely there are times when people, firms, or financial market participants lose sight of reality and become too optimistic or too pessimistic. … But these are more the exception than the rule, and it is not clear that economists can say much about those times anyway. When thinking about the likely effects of a particular economic policy, the best assumption to make seems to be that financial markets, people, and firms will do the best they can to work out the implications of that policy. Designing a policy on the assumption that people will make systematic mistakes in responding to it is unwise.

- Olivier Blanchard, Macroeconomics (7th Edition, 2017), Ch. 16 : Expectations, Output, and Policy